[March 2012 Update: The Senate passed a version of the JOBS Act today with the Merkley-Brown Amendment, which includes a number of safeguards for investors: It requires publicly audited financials for companies seeking over $500,000, additional accountability for companies, industry registration for funding portals, scalable investment caps for investors, a three-week waiting period after funding closes (before funds are received) to uncover potential fraud, and disclosure of capital-raising fees. While I remain skeptical about the principles and incentives at play in equity crowdfunding as described below, these additions, well executed, could mitigate many of the most serious concerns I’ve expressed here.]

The verb “to disrupt” in all its forms is rightly popular in the startup world. To many entrepreneurs, few things are as personally satisfying (or as lucrative) as disrupting an entrenched, complacent, monopolistic, inefficient or stagnant market in ways that often empower consumers and producers alike. Consumer Internet and mobile technology businesses continue to be rife with opportunities for disruption.

On March 8, 2012, the U.S. House of Representatives passed the JOBS Act, becoming the subject of much chatter at this year’s South by Southwest Interactive (SXSW) conference that began the following day. This bill is the latest in a series of efforts and initiatives in recent years intended to disrupt the traditional methods and markets for investment in, and capitalization of, emerging growth businesses. Boosters can be found all over the Web proclaiming a nascent equity crowdfunding revolution that will ensure prosperity for entrepreneurs and mom-and-pop investors alike. As a lawyer, advisor, investor, director and co-founder myself, I am an ardent advocate for entrepreneurs, startups, and the individuals and institutions that fund them. Yet I simply can’t support equity crowdfunding in the form authorized by the House bill for reasons I’ll get into below. To cut to the chase, I believe it would lead to disastrous consequences for minimal gain, creating perverse incentives that would enrich the most “ethically challenged” hucksters, deplete the assets of those who can least afford it, while continuing to leave the most attractive investments to financial institutions and high-net-worth individuals—traditionally, venture capital firms and angel investors.

My colleague at Gust Blog, veteran angel investor Bill Payne, has written a series of outstanding posts on the subject already. If you’re new to the subject, I highly recommend reading this post by Bill, which is more balanced than mine, neatly summarizing the pros and cons, risks and benefits. I’d like to supplement his pieces with my own perspective, developed as an in-house and outside lawyer for startups and investors over the past 15 years. In the course of my career, I’ve counseled clients in matters ranging from $10K friends-and-family convertible debt seed financing for new startups to overhauling a Nasdaq 100 company’s financial disclosure controls and securities compliance as Chairman of the Disclosure Committee in the wake of the Sarbanes-Oxley Act of 2002.

First, it’s important to define what we do and don’t mean by “crowdfunding.” There are various ways of collectively funding new initiatives, such as pooling donations to a non-profit entity  or facilitating collective sponsorship of creative projects as Kickstarter does. There are also startups funded by a large number of individual angel investors or groups, all of whom meet the criteria for “accredited investors” under current U.S. securities law. Those are all worthy pursuits that fall outside the scope of this discussion.

or facilitating collective sponsorship of creative projects as Kickstarter does. There are also startups funded by a large number of individual angel investors or groups, all of whom meet the criteria for “accredited investors” under current U.S. securities law. Those are all worthy pursuits that fall outside the scope of this discussion.

My definition of the type of equity crowdfunding contemplated by the JOBS Act — more accurately dubbed “crowd investing” — is the making available of equity shares in a for-profit business enterprise for investment in relatively small dollar amounts by a relatively large number of individual investors who do not meet the traditional “accredited investor” criteria.

Anyone in the securities industry will find this to be a familiar description. It sounds virtually identical to something called an “initial public offering,” or IPO. You can find Facebook’s regulatory filing for its upcoming IPO, known as a registration statement on Form S-1, on the SEC’s EDGAR website in all its 190 pages of glory. (I previously published an analysis of the 22-page “Risk Factors” section in collaboration with Dan Rowinski of ReadWriteWeb.) To “go public” involves filing this kind of registration statement under the Securities Act of 1933, subject to review by the SEC and amendment in response to its comments; preparing five years of historical financial information, to be reviewed and audited by an independent accounting firm and published in the registration statement; meeting both qualitative and quantitative listing criteria to be traded on a stock exchange; committing to governance standards such as having an audit committee comprised of independent directors; and committing to indefinite updating of the company’s public disclosures in the form of quarterly financial reports, annual audited financial statements with more extensive disclosure, and annual proxy statements in connection with the election of directors, as well as real-time reporting of significant events and transactions by insiders, among other things.

Equity crowdfunding involves offering the same kind of securities to the same kind of public buyers with precisely none of the above. The lack of transparency is justified by limiting the amount of capital any one investor can lose, and/or the amount the company can raise, to figures small enough to meet someone’s arbitrary standard of relative harmlessness. If that sounds reasonable to you, I’d be happy to confiscate $100 apiece from 10,000 readers to walk away a millionaire while leaving you with no recourse. (Libertarians are understandably outraged when the government does that in the form of taxation.)

Securities regulation in the United States is a disclosure-based system. The SEC does not pass on the merits of any particular investment per se. The primary purpose of securities laws and regulations, and their enforcement, is to protect investors from  fraudulent and deceptive practices in a situation of radical information asymmetry. The people running a company know literally everything about it; outsiders know literally nothing except what is disclosed, either voluntarily or through government coercion. Even then, as investors, we have no guarantee that what is disclosed by the company resembles the truth — a lesson bitterly learned through destruction of untold billions of dollars of shareholder value by Enron, WorldCom and their ilk. Sabanes-Oxley was passed out of desperation when it became clear that even the very largest NYSE-traded companies with blue-chip auditing firms were able to get away with massive accounting fraud by reporting figures that were manipulated and distorted. Our trust, as it turned out, was misplaced.

fraudulent and deceptive practices in a situation of radical information asymmetry. The people running a company know literally everything about it; outsiders know literally nothing except what is disclosed, either voluntarily or through government coercion. Even then, as investors, we have no guarantee that what is disclosed by the company resembles the truth — a lesson bitterly learned through destruction of untold billions of dollars of shareholder value by Enron, WorldCom and their ilk. Sabanes-Oxley was passed out of desperation when it became clear that even the very largest NYSE-traded companies with blue-chip auditing firms were able to get away with massive accounting fraud by reporting figures that were manipulated and distorted. Our trust, as it turned out, was misplaced.

In the lexicon of economics, this is a variety of principal-agent problem in which a moral hazard exists for a company to take more risk than its investors would take under the same circumstances. (If you find the term “moral hazard” muddies the waters, simply replace it with the concept of gambling with “other people’s money” rather than your own. This very concept of spreading risk widely enough that it’s unrecognizable by the investors taking it turned out to be at the heart of the subprime mortgage crisis.) There is no reason to assume that these problems will magically go away with respect to companies below a certain size, or raising an amount of capital less than $X, or in purchases of less than $Y from any single investor. In fact, as I’ll explain, the risks are exacerbated and amplified by orders of magnitude as a consequence of basic economic principles and a recent U.S. Supreme Court decision.

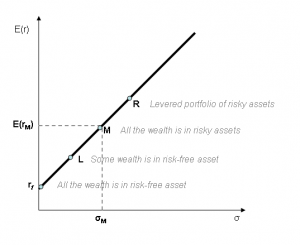

One of the fundamental tenets of investing is that risk and return are positively correlated. The more risky an investment, the more it must pay investors to find that risk acceptable. The “invisible hand” of market forces described by Adam Smith makes this so. Setting aside the theory, anecdotally, any early stage investor has examples of worthless stock written off after a bad investment as well as (hopefully) spectacular returns from the home-run hitters. The portfolio approach followed by VCs and angels arrives at an outcome that should ultimately be a healthy rate of return in the long run at the cost of great short-term volatility and illiquidity.

Valuation of private companies is more of an art than a science. Sophisticated institutional investors with decades of experience can and do regularly disagree about the fair pre-money valuation of a startup. Nevertheless, existing securities law treats these investors as “grown-ups.” Through exemptions such as Regulation D under the Securities Act, accredited investors can invest in a startup without putting the company through the onerous disclosure and governance requirements described above for public companies, which would be prohibitive. The only reason this makes any sense is that investors typically have both economic incentive and bargaining leverage to conduct thorough due diligence reviews, negotiate protective provisions and investor rights, get a seat on the Board of Directors (or at least an observer seat, affording them access to the same flow of detailed inside information that the Board receives), and so on. Even so, the best investors get it wrong much of the time, like Hall-of-Fame baseball players who still miss more pitches than they hit.

Valuation of private companies is more of an art than a science. Sophisticated institutional investors with decades of experience can and do regularly disagree about the fair pre-money valuation of a startup. Nevertheless, existing securities law treats these investors as “grown-ups.” Through exemptions such as Regulation D under the Securities Act, accredited investors can invest in a startup without putting the company through the onerous disclosure and governance requirements described above for public companies, which would be prohibitive. The only reason this makes any sense is that investors typically have both economic incentive and bargaining leverage to conduct thorough due diligence reviews, negotiate protective provisions and investor rights, get a seat on the Board of Directors (or at least an observer seat, affording them access to the same flow of detailed inside information that the Board receives), and so on. Even so, the best investors get it wrong much of the time, like Hall-of-Fame baseball players who still miss more pitches than they hit.

Small investors, as in equity crowdfunding, have neither the economic incentive nor the negotiating leverage to do any of the above. They are therefore expected to make investment decisions involving the riskiest of investments in a near-total information vacuum. Common sense suggests that in this kind of scenario, the little guys need more protection in the form of regulations mandating certain types of financial and other disclosure. Unsurprisingly, the existing exemption most commonly used by startups (Rule 506 of Regulation D) requires exactly that! The primary reason most startups won’t allow non-accredited investors (other than founders) to invest is that Reg. D requires them to prepare fairly extensive disclosure materials to be delivered to those non-accredited investors. While less onerous than going public, it’s a headache that most early stage startups want or need to avoid.

A committed libertarian might shrug at all of this and suggest investors should be expected to bear risks and reap rewards on their own, keeping government out of it. Regardless of the merits of that view, equity crowdfunding law as proposed would be a bizarre distortion that turns it on its head. If investors are to be left to fend for themselves, it should logically be with respect to investments in the largest, Fortune 500-type companies that offer far more disclosure voluntarily and whose stock prices are far less volatile. Instead, JOBS Act-style equity crowdfunding legislation is a form of targeted deregulation of the financial markets aimed exclusively at investors who by definition have assets or income placing them squarely in the middle class and are making investments so small that in reality they have neither the leverage nor the economic incentive to demand adequate disclosure by issuers. An economics professor could hardly dream up a better textbook example of guaranteed market failure. (Law professor Barbara Black has also written on the subject.)

Many investments become worthless. People will make bad or uninformed decisions, or invest on the basis of misleading, deceptive or fraudulent information. In the case of equity crowdfunding, when this happens, who will they blame? The answer is not themselves; our culture simply doesn’t work that way in this litigious age.

What about intermediaries who could impose some order on the chaos, disclosure standards, and so forth? The inherent trade-offs are insurmountable: The more transparency and accountability required of issuers, the more the entire point of being crowdfunded disappears. With a less transparent, unregulated market, more investors will inevitably be deceived, misled or defrauded. This goes hand-in-hand with the liability question. Securities litigation has been a thorn in the sides of technology companies for decades. (It’s often jokingly said that a rite of passage for any publicly traded tech company is its first securities class action or derivative suit.) For a private company, increasing the number of shareholders by orders of magnitude will also increase the probability of litigation by orders of magnitude, unless Congress acts to specifically shield crowdfunding issuers from liability. So naturally that kind of immunity has been floated in some of the proposals currently on the table. Without it, proponents argue, companies would be afraid to try equity crowdfunding. Adding immunity to the mix takes a situation from bad to worse, where the nearly-unaccountable become totally unaccountable. This starts to sound like sheer insanity.

It gets better. Add the concept of adverse selection and we have the makings of a Microeconomics 101 final exam. Adverse selection is the concept that “bad” inefficiencies result when parties have asymmetric information (see a pattern here?). For example, people with enormous appetites gravitate to an all-you-can-eat fixed-price buffet while light eaters are more likely to stay away, costing the restaurant more than expected. Such is the case with a funding mechanism that is designed from the ground up to leverage a large number of individual investors with minimal bargaining power under circumstances involving minimal disclosure, toothless corporate governance and little-to-no liability to shareholders. What sort of business operators can we predict will be disproportionately drawn to using this kind of fundraising mechanism?

Finally, even if Congress were to refuse to limit or eliminate liability from securities litigation against crowdfunded companies, the U.S. Supreme Court might well do it for them under its recent AT&T Mobility decision. To understand why, it’s important first to distinguish between individual lawsuits and class actions. Litigation is expensive. If I invest $100,000 in a company that deceives or defrauds me, it might well be worth suing individually, particularly if I can find a plaintiffs’ lawyer to take my case on contingency (e.g., 40% of the proceeds). If I invest $1,000, not so much. In the real world, this means companies will never get sued for securities fraud except (1) by individual shareholders with large stakes that make it worthwhile (usually hedge or pension funds), or (2) by numerous shareholders bundled together in a class action lawsuit—usually instigated by the lawyers, it should be noted, not the shareholders—on behalf of everyone similarly situated.

This individual-versus-class action distinction becomes critical in many contexts, including consumer protection and employment as well as securities, where there may be a large number of people with relatively small claims that wouldn’t be worth litigating individually but multiply out to a large total dollar amount. States such as California, siding with consumers, have restricted companies’ ability to eliminate class actions in their contracts as AT&T tried to do in its cell phone service contract. That is a controversial subject and a separate discussion in itself, but the point here is that the U.S. Supreme Court struck down California’s law in the AT&T Mobility case, restoring companies’ ability to require as a condition of doing business that customers agree to waive any right to class action litigation and/or agree to 1-on-1 arbitration with the company. If you wonder who would ever insist on spending the time and money to go to arbitration for a $150 dispute with AT&T over a cell phone bill, you see exactly why this matters.

It’s far from certain whether the AT&T Mobility precedent will extend to matters outside consumer protection, such as securities litigation, but much of the legal community is mobilized to push things in that direction and test its boundaries. We should expect contracts that involve high-volume, low-dollar-amount transactions to require a class action waiver in every conceivable setting unless and until the Supreme Court sets a clear boundary. Crowdfunding is a perfect application for this change, and I would therefore be shocked if every subscription or purchase agreement for an equity crowdfunding deal under the new law (if it passes) doesn’t contain such a waiver. That would have the practical effect of eviscerating any legal remedy for securities fraud against unscrupulous businesses using crowdfunding.

It should be clear by now that the very attributes that make equity crowdfunding an attractive tool for raising capital also comprise a disaster waiting to happen. One person’s barriers to investment are another’s indispensible safeguards. There is a cost to transparency and accountability which small enterprises are understandably reluctant to bear. Nevertheless, eliminating those things while throwing the doors open to members of the general public who are less able to bear the complete loss of an investment than accredited investors, would have trouble valuing an investment even in the face of perfect information but in fact receive almost none (and of dubious veracity), and are left with no legal recourse if defrauded, seems like a dream come true for predatory con artists and hucksters.

Thanks to Pei Patrick Kuo for contributing to this article, based on the original post at Gust Blog.